What is Mintpay?

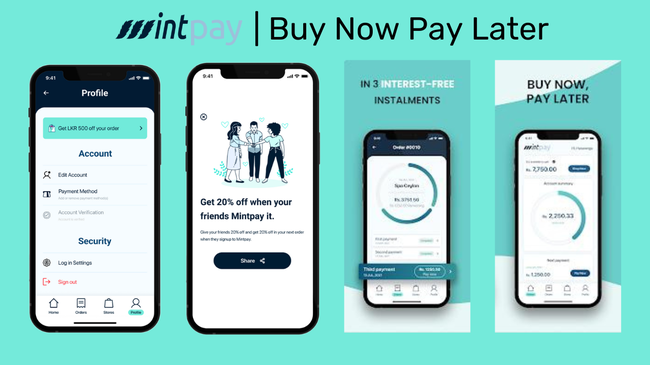

Mintpay.lk is a ‘buy now, pay later’ online shopping site in Sri Lanka. Which means, with Mintpay Sri Lanka, you can buy your favorite products online now or whenever you want and pay for it later. Mintpay offers interest-free installments to pay back over a period of two months.

With Mintpay, you can shop your favorite products in many different stores in Sri Lanka. Simply download the app and enjoy an all-in-one online shopping experience at the comfort of your home. Mintpay has partnered with many of your favorite local stores, to mention a few Mintpay merchants - Nils, DSI, Mosh, Spa Ceylon, Mimosa, Midnight Divas and many more!

Mintpay Loan, how does it work?

Just like any other ‘buy now pay later’ online shopping app, Mintpay lets you shop your favourite products now and pay in 3, interest free installments over a period of two months.

Simply download the Mintpay app and register yourself. Once registration is completed, you can start shopping at a wide range of online stores and pay for everything later.

What is ‘buy now, pay later’?

Mintpay allows you to buy now and pay later. Meaning, you will be given credits to buy your favourite products now or whenever you want. These credits will be allocated on the basis of your profile. Once you make a purchase using these credits, you can sit back and relax and pay this loan later in three installments. Mintpay lets you settle this amount in three interest free installments in over a period of 2 months. In summary, it allows you to buy the product now and pay for it whenever you want.

Now here’s something Interesting! With Mintpay, you can not only buy your favourite products online, but also shop them in your nearest shop that’s partnered with Mintpay.

How much is the Mintpay loan?

The amount you can borrow is based on your profile. Once you register with Mintpay, you will find this information in the Mintpay app. The more purchases you make with Mintpay, the higher the credit limit gets – assuming you make the repayments before the due date.

What is the Interest Rate?

It’s Interest Free! Mintpay lets you pay in three interest-free installments over 2 months. Late payments are subject to a late fee of Rs.500/- and a further Rs.300/- if the payment remains unpaid 7 days after the due date, however if you miss a payment, Mintpay will automatically pause your account until you are back on track.

Also keep in your mind that missing payments or not settling payments on time may result in lower credit/split limits.

Is Mintpay safe?

Yes! Mintpay is a secure, reliable way to shop online without any worries. Mintpay is a product owned and operated by Mintpay (Private) Ltd, a company duly incorporated and registered under the laws of Sri Lanka.

How to use Mintpay?

Mintpay is easy to use and secure. Simply follow the below steps and start shopping now.

- Download the Mintpay App

- Enter your mobile number and complete verification

- Add your NIC and fill in personal details

- Fill in your address details

- Fill in your email address and password

- Upload a selfie

- Upload both sides of your NIC

- Complete Verification

- Shop your favourite products

- Choose Mintpay at checkout

Make your first payment now and the rest over 2 months in 3 installments

What are the requirements for a Mintpay Loan?

- Be at least 18 years old

- A valid email address and a phone number.

- A bank payment card issued by a bank in Sri Lanka - Visa/Mastercard/debit/credit card

- A valid NIC/ Driver’s License or Passport

- Be a resident in Sri Lanka

How to pay Mintpay Installments?

You can pay your Mintpay installments over 2 months through the bank cards entered in the Mintpay app. Mintpay will automatically debit the amount from your bank card and all you have to do is make sure there is enough balance.

What happens if I miss a payment?

Mintpay will send you frequent reminders closer to your payment due dates to help you settle the payments on time. However if you still fail to settle the payment, Mintpay will pause your account to stop you from making any further purchases. In addition, Mintpay will also charge a late fee of Rs. 500/- and a further Rs. 300/- if you fail to repay within 7 days after the due date.

How to increase credit limit?

The more you shop, the higher the credit limit is. So If you are a constant shopper and with a good credit history, you'll be able to increase your credit limit.

Mintpay Benefits

You can enjoy many benefits with Mintpay.

- Interest free installments

- Buy now pay later

- Signing up is simple

- Get exclusive deals

- All your favorite stores in one app

- No fees when you pay on time

- Get payment reminders

- No hidden fees

What is ‘Refer a Friend’?

With Mintpay, you can enjoy 20% off (up to Rs. 1000 off) when you refer a friend to use Mintpay. Share your referral link with friends and both of you can enjoy this offer!

Not only that, you can also refer an unlimited number of friends to Mintpay and enjoy the offers every time a friend uses Mintpay! So don’t hold back!

Mintpay App

Mintpay app is easy-to-use and you can find all your favorite stores with just one click.

- You can download the Mintpay app through the Google Play Store here

- You can download the Mintpay app through the App Store here

Mintpay Customer Service

You can simply write to Mintpay regarding any issue you have with the Mintpay app or any other feature through the email address support@mintpay.lk

Unfortunately there isn’t a Mintpay contact number to call them directly.

Mintpay Reviews

We analyzed both Google Play store and App store reviews to give you a better understanding of the Mintpay App.

It seems to be that Mintpay has good reviews in the App store and customers are quite happy with the app and it’s features, whereas Mintpay has quite a considerable number of negative reviews in Google play store and customers have complained quite a lot about the poor functionality of the app.

However these negative reviews are mainly about the functional issues of the app like Log-in issues, verification failure, payment failure etc.

So in our opinion, these aren’t major deal breaking reviews but yet wise to consider when using the Mintpay app if you’re an Android user.

Have you used Mintpay? Share your experience here!